- +971 4242 5253

- info@aey.ae

- Mon - Fri: 9:00 - 18:30

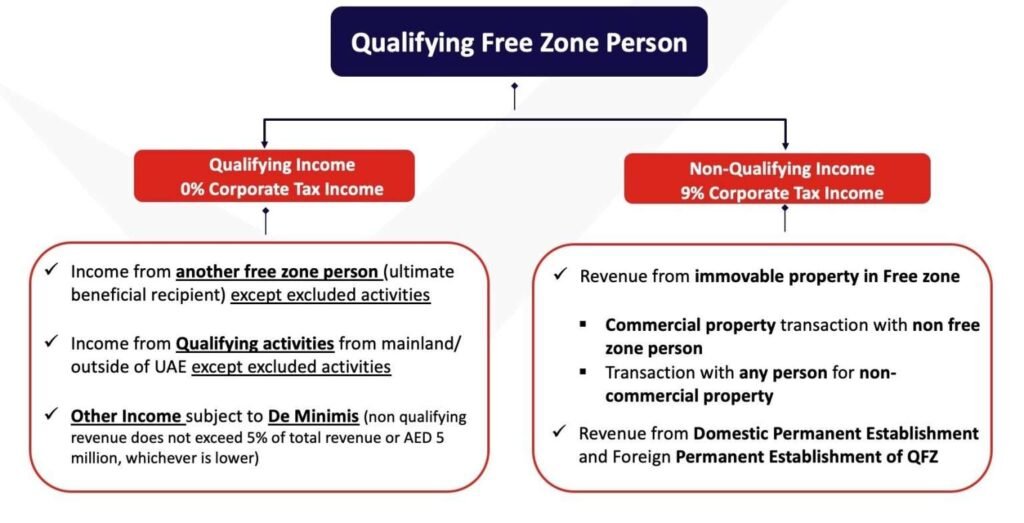

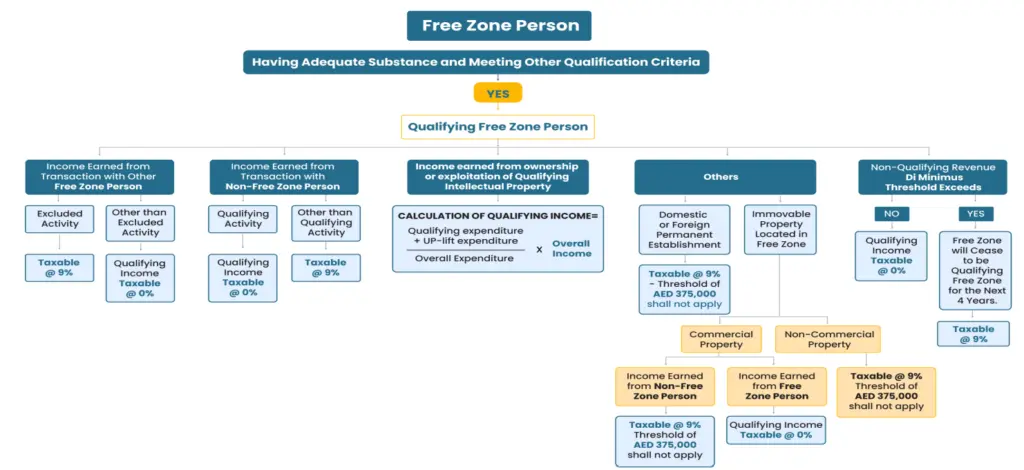

A “Qualifying Free Zone Person” refers to an entity Qualifying activities are those that generate qualifying income. They include transactions between free zone persons and certain activities involving intellectual property. Activities not classified as excluded are typically considered qualifying, thus benefiting from preferential tax treatmentsin a free zone that meets the conditions to benefit from the reduced or zero tax rates, depending on their income sources and activities. These entities must adhere to the provisions outlined in the Corporate Tax Law and Cabinet Decision.

Income generated from qualifying intellectual property, such as patents or copyrighted software, is considered qualifying income, provided it meets the criteria outlined in the decision. However, income from non-qualifying intellectual property is taxable.

Total revenue includes all income derived by a qualifying free zone person within a tax period. However, certain transactions, particularly those involving immovable property, are excluded from this calculation. Understanding the composition of qualifying and non-qualifying revenue is essential for businesses to ensure they remain within the prescribed limits.

Whatever your question is, our team will lead you to the right direction.

+971 56 413 4070

info@aey.ae

Your business is special. Let us calculate your dreams

The The Minimum requirement ensures that a free zone person’s non-qualifying income does not exceed a certain percentage or amount of their total revenue. Exceeding this threshold may result in the loss of qualifying status.

Free zone persons must report their income, maintain adequate substance, and comply with the The Minimum requirement to remain eligible for tax exemptions.

Whatever your question is, our team will lead you to the right direction. .